I’m still gazing at the New York picture papers from 100 years ago, especially trying to keep alert for anything that might relate to the American Civil War. Recently I noticed a thumbnail that looked like an old cabin. Could the photo possibly have anything to do with Abraham Lincoln, who the federal government assures us was born in a log cabin? After all, nowadays we have replica history and even reenactors.

Upon enlargement it was evident that the picture I was looking really had nothing to do with the Civil War. However, the photo was taken in Kentucky, where the sixteenth president was born. The man in the picture was about as old as Mr. Lincoln would have been had he lived. The Kentucky centenarian’s occupation was probably related to government efforts to pay for Mr. Lincoln’s war. From the August 11, 1918 issue of the New York Tribune:

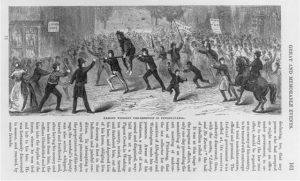

As you can read at taxhistory.org, the federal government raised money during the Civil War by issuing bonds and increasing taxes, including a tax on liquor:A table at Wikipedia shows that excise taxes accounted for a substantial part of federal revenue from 1865 through 1915 and they returned in 1928. I’m assuming that at least some moonshine was produced to avoid the government revenooer. Some people made their own spirits on the sly. As early as December 1867 Harper’s Weekly published a drawing of the illicit Southern mode of distillation. By 1877 moonshine culture had developed to such an extent that the same magazine published a page of images related to the “Moonshine Man” of Kentucky. Harper’s featured a similar page about “crooked whiskey in North Carolina” in 1879.The Internal Revenue Act of 1862, enacted by Congress in July, 1862, soaked up much of the inflationary pressure produced by Greenbacks. It did so because the Act placed excise taxes on just about everything, including sin and luxury items like liquor, tobacco, playing cards, carriages, yachts, billiard tables, and jewelry. It taxed patent medicines and newspaper advertisements. It imposed license taxes on practically every profession or service except the clergy. It instituted stamp taxes, value added taxes on manufactured goods and processed meats, inheritance taxes, taxes on the gross receipts of corporations, banks, and insurance companies, as well as taxes on dividends or interest they paid to investors. To administer these excise taxes, along with the tariff system, the Internal Revenue Act also created a Bureau of Internal Revenue, whose first commissioner, George Boutwell, described it as “the largest Government department ever organized.”

An apparently Republican campaign document during the 1868 election campaign showed how war debt and taxes had decreased since the war under the Republican-led Congress, but the federal government was still taxing “Distilled Spirits, Beer, Tobacco and Playing Cards”

![New-York tribune (New York [N.Y.]), August 11, 1918 (LOC: https://www.loc.gov/item/sn83030214/1918-08-11/ed-1/)](https://www.bluegrayreview.com/wp-content/uploads/2018/07/NY-Trib-8-11-1918-1024x479.jpg)

![Illicit distillation of liquors--Southern mode of making whisky [sic] / sketched by A.W. Thompson. ( Illus. in: Harper's weekly, v. 11, no. 571 (1867 Dec. 7), p. 773. ; LOC: https://www.loc.gov/item/2001700339/)](https://www.bluegrayreview.com/wp-content/uploads/2018/07/3c30290v-1024x816.jpg)

![Proclaim the truth! Financial management of the Republican party ... [n, p. 1868]. (1868; LOC: https://www.loc.gov/item/rbpe.23602500/)](https://www.bluegrayreview.com/wp-content/uploads/2018/07/republicantaxtruth1868-150x150.jpg)

!["The moonshine man" of Kentucky [Composite of 5 scenes of moonshining showing man cutting down tree, man mixing ingredients, moonshiner held captive by 3 men, 3 men on horseback begging for breakfast from framer and boy holding jug by still house] ( Illus. in: Harper's Weekly, v. 21, (1877 October 20), p. 820. ; LOC: https://www.loc.gov/item/99614166/)](https://www.bluegrayreview.com/wp-content/uploads/2018/07/3a01307r-150x150.jpg)