150 years ago this week the Confederate government revived an old idea in order to obtain new supplies for its armies in the field. On May 24, 1863

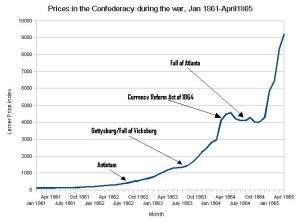

To combat spiraling inflation, the Confederate Congress levies a 10 percent “tax [in] kind” on [seemingly] all produce harvested throughout the South. This move is resented greatly by the agrarian sector, which is already subject to requisition by the Confederate commissary and quartermaster offices.[1]

An editorial from the Richmond Examiner on April 3, 1863 supports a tax-in-kind as a way to control the money supply. “Inflation of the currency is the source of the chief evils which now disturb us.” The government is forced to print hundreds of millions of dollars every year to buy supplies at relatively high prices for its huge armies. And maybe also for the populace to pay their taxes?

There is but a single remedy…which promises relief. It is to make a levy of taxes in kind.–This will at once take the Government out of the market as a purchaser of the heaviest part of its stores and supplies. Consequently, the issue of Treasury notes will be so much diminished, that the absorption caused by the Tax and Currency Bills will be greater than the quantity of new paper thrown on the markets.–The volume of the currency will be rapidly diminished to a manageable amount, and the relative values of gold and everything else restored to their usual state.

And the editorial points out that the new kind of tax wouldn’t require a new bureaucracy because the government was already impressing goods and labor for the war effort.

From the same article at Encyclopedia Virginia:

Enacted in April 1863, tax-in-kind operated similarly to the Impressment Act. Farmers were required to donate 10 percent of certain crops, such as corn, wheat, and sweet potatoes, to tax-in-kind collectors operating under the auspices of the War and Treasury departments. As with impressments, the collectors and farmers negotiated how to calculate 10 percent. Also as with impressments, fake agents stole crops and the government enforced the law haphazardly, causing some Confederate citizens to ask which was the worse scourge, the Union army or Confederate impressment and “TIK-men,” as the tax-in-kind agents were derisively called. Still, at least one scholar has estimated that tax-in-kind generated $62 million for the Confederacy between 1863 and 1865.

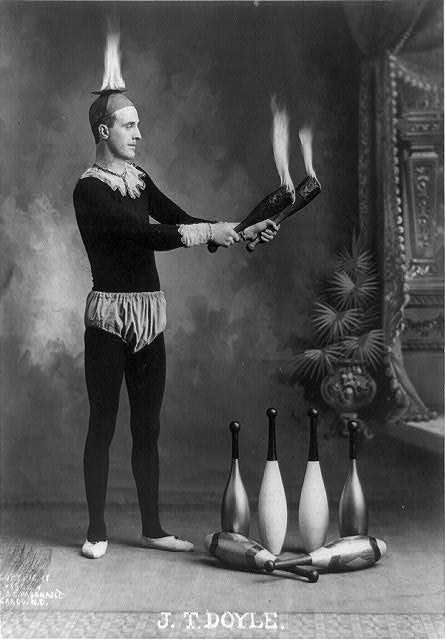

You can read the amended April 24, 1863 law at the University of North Carolina. The tax in kind was aimed at farmers, but there were many other taxes that effected large parts of the population, including a tax on salaries. Many professions and businesses were levied specific taxes. There were taxes on butchers and bakers, brewers and bankers, and on and on. While books and newspapers were exempt, bowling alleys, billiard rooms, and circuses were assessed taxes. Jugglers were charged $50 – the category “juggler” contained “other persons exhibiting shows” and “Every person who performs by slight of hand shall be regarded as a juggler under this act …” … pickpockets? … politicians?

- [1]Fredriksen, John C. Civil War Almanac. New York: Checkmark Books, 2008. Print. page 285.↩